The main objective of the market is to place salesmen in contact with potential clients, thus creating means of exchange for assets and services which favors both parties. Traditionally, our understanding of the market has been centered on physical places which we commonly know as stores. However, this limited notion of what we understand as the market is seriously questioned, given that consumers, technologies and products have evolved and that which is physical now only constitutes a part of it. Although the exchange idea is essential for the market to function, the sales channels are those that are being transformed with more innovative ways to approach the consumer: internet, direct sale and vending machines make up what is known as non-store retailing in a new era of retail which has presented substantial growth in Latin America throughout the last five years, thanks to it being a well received tendency throughout the region. Its annual growth, in many cases with double digit numbers, occurred in the main markets and in a wide range of products, which indicates that the Latin American market is entering a new stage of retailing, dominated not by walls or aisles, but by screens and pages: A stage which we will call Retail 2.0.

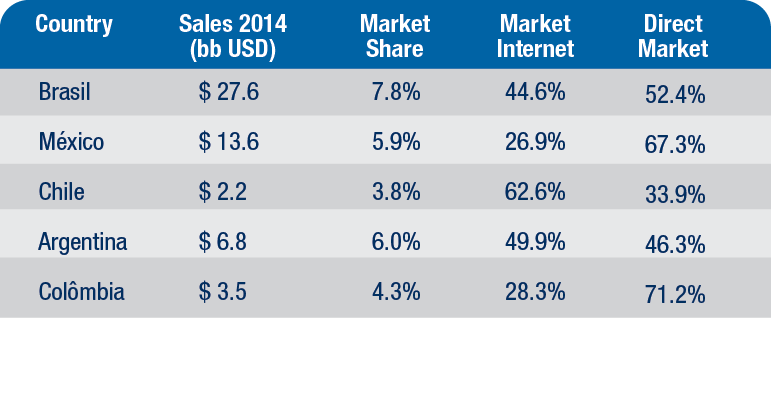

We are living in a time in which interesting signs are seen in the market: on one hand there is Amazon opening its first physical store, and on the other hand Radio Shack declares bankruptcy before the online competition. What is happening in the retail sector? In spite of currently having the participation of less than 6% of the total retail market of Latin America, a boom in the region regarding non-store retailing is apparent: its average annual growth in the last 5 years was 10.6%, while that of store-based retailing was just 5.5%. This surge has strongly developed in countries like Chile (14.6%), Colombia (13.3%), Brazil (9.8%), and Mexico (9.1%) and is about to take hold in the rest of Latin America with the same speed.

FIGURE 1. PARTICIPATION OF NON-STORE RETAILING AND ITS RESPECTIVE CATEGORIES

FOR LATIN AMERICA (2014)

Technologies and innovations such as the internet and direct sale have been the key proponents of this trend, which the Latin America consumer is already starting to assimilate as a model in their personal lives. According to John Burbank, president of Iniciativas Estratégicas de A.C. Nielson, “The consumer appetite for browsing online is stronger in developing regions and Latin Americans are enthusiastic online buyers ”. In fact, Latin Americans increasingly and habitually access their banks, pay their services, do their grocery shopping and buy non-perishable items online. Online sales have not grown a total of 196.7% since 2008 in vain.

FIGURE 2. GROWTH IN SALES AND PARTICIPATION IN THE NON-STORE CHANNEL MARKET

(2010-2016F)

For its part, direct sales in the region have not had an exorbitant growth like its counterpart (49.1% since 2008), but they continue to have a significant increase. This channel has acquired particular importance since “exclusiveness of products, lack of consumer time and greater purchasing power are invigorating this niche”, according to Paula Estévez, manager of Nielsen Home Panels.

FROM WALLS TO PAGES

The Latin American market has generally been characterized by inclination towards purchases in conventional channels of retailing such as neighborhood stores or supermarkets; however, this is changing due to the arrival of the new phase of Retail 2.0, in which it is evidenced that consumers are becoming more sophisticated, better informed and even more careful and intelligent regarding their purchasing habits. Each year, non-store retailing is taking an average of 0.2 participation percentage points from the conventional channels and, although today this channel only occupies a small percentage of sales in the total retail segment, there are several companies that have capitalized on these sales channels: Avon, Natura, Lojas Americanas, Mercado Libre and Amazon, to name just a few examples.

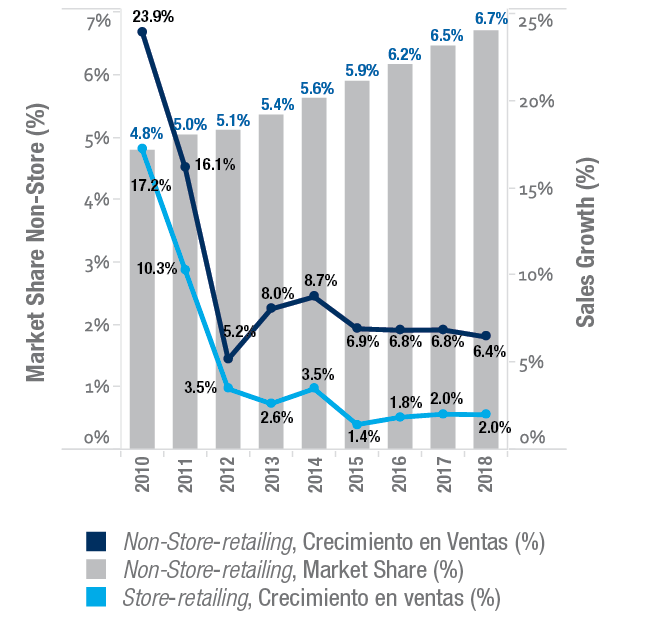

The total growth figures between 2008 and 2013 continue to surprise, given that some countries have surpassed the 100% barrier, as is the case of Argentina (201.0%), Mexico (113.8%) and Chile (110.8%). Internet sales and direct sales contribute more than 90% of sales within the non-store retailing format, however, the preference of a non-store channel over another radically varies depending on the socio-economic and cultural conditions of each country.

TABLE 1. COUNTRIES WITH GREATER SALES IN THE NON-STORE CHANNEL AND ONLINE

AND AND DIRECT SALE PARTICIPATION (2014)

For example, Chile is one of the most advanced countries in the practice of Retail 2.0, above all on the internet, given that it maintains its companies on the forefront of this channel. According to Credit Suisse and information supplied by leading companies in this channel, e commerce is growing 35% annually and represents 6% of the total sales from department stores in Chilean territory. On the other hand, the majority of the other countries hold direct sales as the most represented format and see great potential in it. In the case of Colombia, this channel surpasses the internet retail market by more than 40 percentage points. So much is the success that companies have had through this channel, that new industries such as that of food (Novaventa) and liquor (Pernod Ricard) are venturing into this sales method. Thanks to this new income, the growth of sales from this format was impacted by 26.3% during the first semester of 2014 .

It should be mentioned that factors such as internet access (both in homes as well as on mobile devices), greater trust by consumers, great online purchase intention, diversification of online markets, among others, are reasons that catalyze the growth of e-commerce in Latin America.

FIGURE 3. GROWTH OF INTERNET ACCESS AND INCREASE IN THE NUMBER OF

SMARTPHONES IN LATIN AMERICA

For its part, the direct sales channel has been growing since 2012 in more than 60% of Latin American countries due to the greater offer of salesmen and also the greater demand of products through this format. According to the Association of Direct Sales in Colombia, “The opportunity for men and women to organize their economic lifes as they wish, the possibility of obtaining additional income and flexibility in schedules and low investment” are attractive reasons for which people work as catalog sales advisors. Almost 7 million people make up this sales force in Latin America, which represents 21% of global sales through this format (USD 178.000 million in 2013). On the other hand, this channel has great coverage and penetration in the pyramid based segments, given that “large families and those of the low stratum tend to be more common clients of direct sales”, according to Paula Estévez. In fact, 75% of sales are concentrated in 64% of the population, which corresponds approximately to the lower stratum and middle-stratum in Latin America.

Given the aforementioned, everything seems to indicate that this is the moment for traditional stores to begin developing new strategies. It is a reality that companies will have to start considering these alternative retail channels in their short-term and mid-term strategies to achieve more efficient ways of attending to their market and fulfilling their value offer towards clients.

THE CHALLENGE THAT MUST BE MET

Consumers increasingly look for greater flexibility in products due to their personal preferences, cultures and consumption habits, for which sales approximations based on a one-size fits all model become obsolete. The overview of Retail 2.0 seems to surpass the common barriers of supply and demand, adding value to the consumer and offering the fair value proposal at the right moment. It’s because of this that companies which seeks to adapt to this new retail environment need to constantly control and adjust their marketing and supply devices.

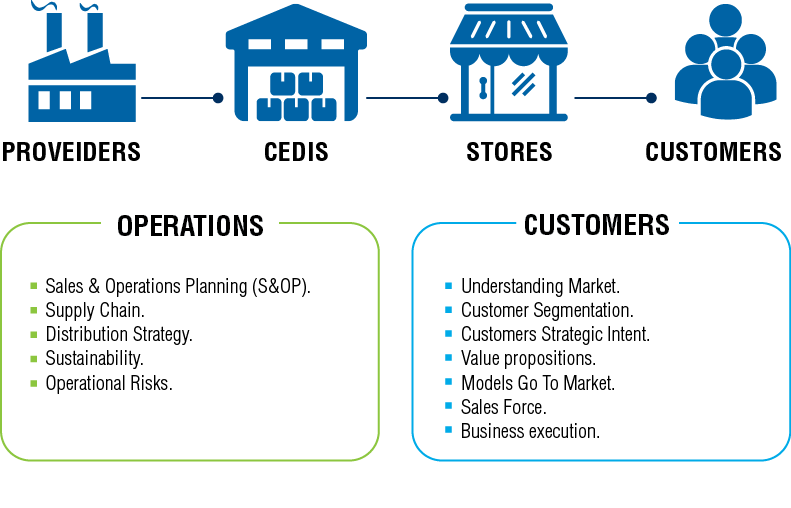

Regarding marketing, adopting a non-store retailing format implies: first, understanding new client habits, understanding their purchase preferences and measuring which characteristics or services clients value over others. Second, and often the most important, it implies establishing a scheme which allows the value offer to the consumer at a fair price to be optimized and uses the adequate distribution mechanism. Several companies have achieved success in the first task without necessarily achieving it in the second, and not only in the area of non-store retailing. At the end of the 90s, the low cost subsidiary of British Airways, Go Fly, failed in spite of the low cost airlines segment being a growing and very active market at the time. Even more famous was the case of when Hewlett-Packard and Compaq tried to imitate Dell´s successful make-to-order distribution, whose implementation failed, leaving no other option other than returning to their traditional distribution models. In both cases, the companies tried to make use of the same value chain for two different business models, which ultimately caused a conflict of resources between two independent business units which were originally designated to complement each other.

FIGURE 4. THE CHALLENGE OF ENTERING IN NON-STORE RETAILING IS IN THE

DISTRIBUTION AND MARKETING WITHIN THE COMPANY´S VALUE CHAIN.

Because of this, in order to successfully complement traditional retail with a robust Retail 2.0 framework, companies must implement these two

formats as separate business models within the same company and must design differentiated value chains, above all with regards to distribution and marketing networks. The main risk of the transition is that two distinct business units may compete for resources from the same value chain, which would end up undermining necessary efforts to achieve the two unique value proposals, a phenomenon which Michael Porter calls “straddling” . The failures of British Airways and the rivals of Dell show a clear example, however, in Latin America, several cases of success have emerged from companies that have overcome these challenged by adopting creative and innovative methods in non-store retailing.

A company that has successfully entered a new Retail 2.0 channel is Danone Mexico, a company that faced the challenge of how to increase consumption of its products in low income segments and less favored sectors. in 2012, the company launched the Semilla initiative with the hope of using the direct sales channel to reach the poorer neighborhoods of the country. The objective was to recruit members of the community who could sell dairy products directly to their friends and family. Thanks to said project, a great impact in the community and a resounding success for the company were achieved, making Danone the retailer with most sales in the non-store channel in 2014, with more than 7.8% of sales participation in the entire country, surpassing the Mexican giant in direct sales, Avon . With the Semilla project, the dairy giant not only unseated its competitors by creating an entirely new market niche from scratch, but it also promoted an entire social project in the process: 85% of the sales force are women and 40% of them are young women who are heads of households. By providing a better quality of life and allowing them to grow through a process of accreditation and training, Danone is giving a solid base to show that the direct sales channel can become a more formal structure, creating as it goes a distribution device which is entirely different for this segment of the market.

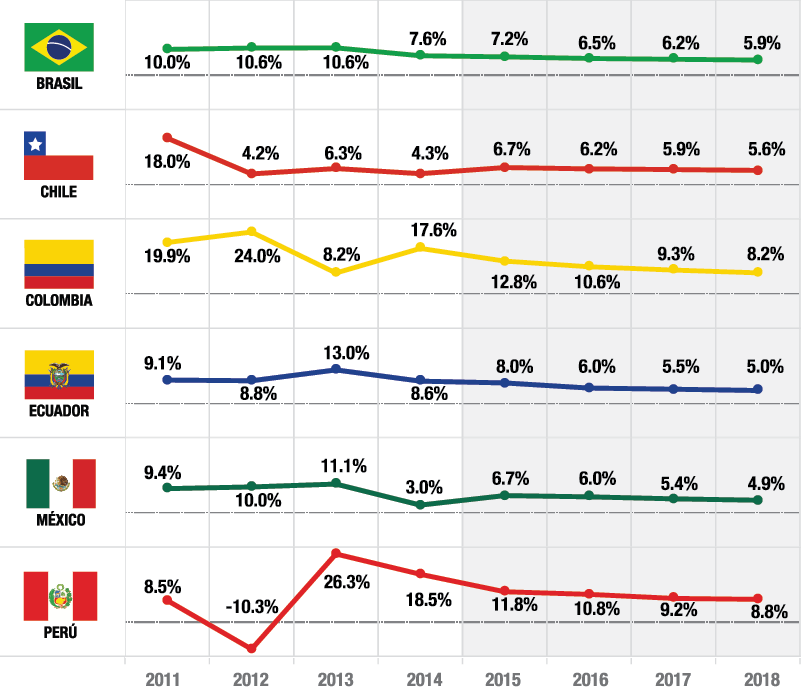

FIGURE 5. ANNUAL GROWTH OF THE NUMBER OF OUTLET STORES IN LATIN AMERICA

COUNTRIES. SLOWDOWN FOR THE PROJECTED 2015-2018 PERIOD.

The common perception that online sales formats present a cannibalization risk for profits from other traditional business models is a bit exaggerated. The fact that the retail format of stores has a sales growth at a healthy rate of 5.5% in the region and that outlet stores are being opened around Latin America at a rate of 14 per day is a testimony of the predominant force that physical stores have among Latin American consumers. However, with the purpose of evolving and defending themselves against the newest and most agile competitors, the challenge which companies must undertake is to allow their non-store formats to perfectly complement their current business models without losing sight of their main business.

A good example is the Chilean firm Falabella, currently the 16th largest retailer in the world, which has maintained its growth in sales points as well as invested in the improvement of the consumer experience online. The company has simultaneously tried to increase the opening of stores throughout Latin America and increase its efforts to improve the performance and scalability of its electronic marketing platform through the restructuring of its TI division, centered on a unique experience for the client. In fact, between 2014 and 2017, Falabella plans to invest more than

23% of its budget in logistics and technological systems to strengthen its multi-channel strategy . The result achieved has been a consecutive growth both in online sales as well as sales in stores throughout the region, although the growth rate by internet has in fact been increasingly greater.

THE NEW ERA

In 1996, when Reed Hastings was forced to pay a $40 fine in Blockbuster due to the late return of a movie, he asked himself if there was a more

effective way to rent and return movies. This incisive thought quickly led to the seed being planted which brought about Netflix and also led to the gradual disappearance of Blockbuster stores throughout the world. Success stories such as that of Netflix should be seen as inspiring, but also